|

|

|

Overview

A Software Identifier (SID) is necessary for the ATO to validate that your company's payroll data submissions are coming from an authorised software service provider (SSP).

You must get a SID for each payer within your PayGlobal database(s).

Key Points

Therefore:

What is a Payer?

The payer represents the registered Australian Business entity making a payment which is subject to withholding, i.e. the company record representing a unique ABN and branch number.

See Appendix 3 - Payer examples

How does it work

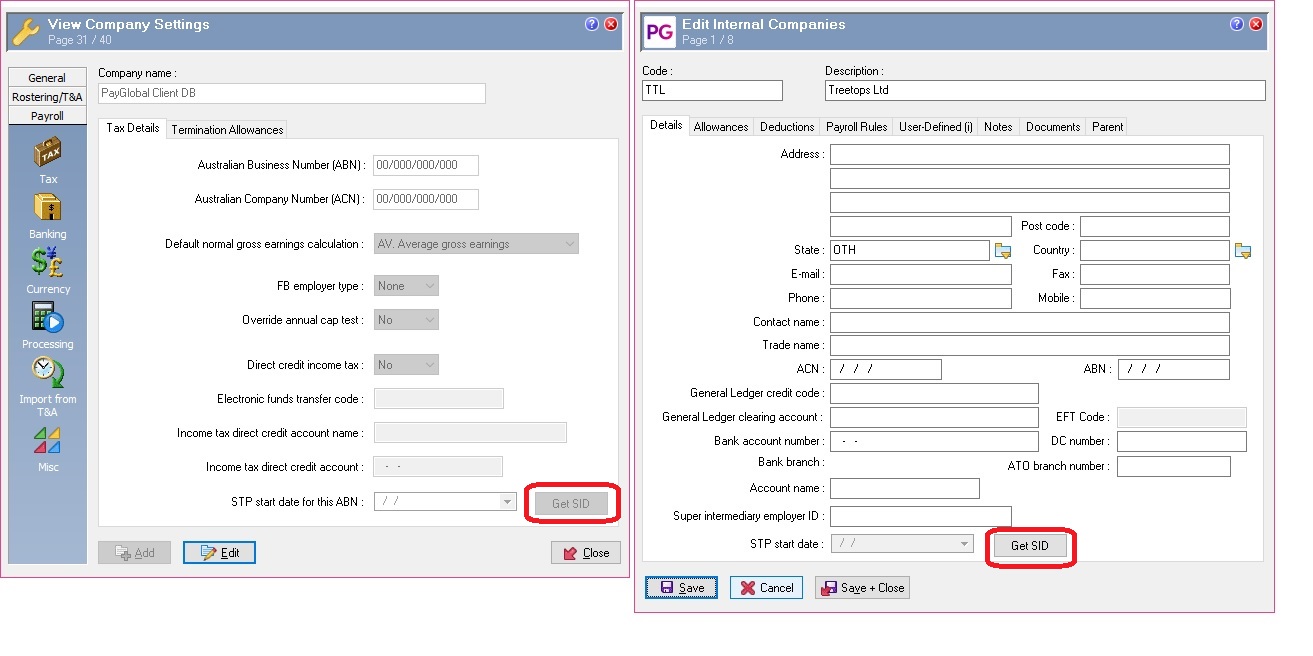

In both Company Settings and Internal Company Settings, there is a "Get SID" button.

This applies to PayGlobal databases with no internal companies and those with one or more internal company record where the ABN and branch number are same as that in Company Settings.

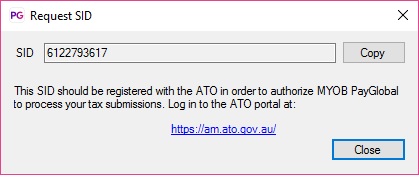

When you click "Get SID", PayGlobal sends a SID request message to the MYOB SBR Service.

Provided your environment is setup (see Get Started ) a SID will be returned.

IMPORTANT: The SID is not stored in the MYOB PayGlobal database, it will only display for the duration you are viewing the company record. If you cancel out of the record or the application before you’ve had a chance to register the SID in the ATO Access Manager Portal, you will need to re-click "Get SID".

What next

You need to register the SID with the ATO.

You can do this by either:

You will need to specify who your SBR software service provider is, you must use MYOB Australia Pty Ltd, ABN = 13 086 760 198

The following link explains how to add/remove a SID

|

|

Topic: 44394